how to register gst malaysia

In Step 3 the OTP is verified and. Softcopy of Bank Statement to attach together with the application 1.

Fssai Registration In 2021 Food Safety Fast Food Canning

The first step is to go to the GST Portal.

. On the other hand if youre looking to make big renovation or if your opening a new place then you could save 6 GST on all kitchen equipments furniture renovations etc. Goods and Service GST Act 2014. Tourists can claim this 6 tax under certain conditions.

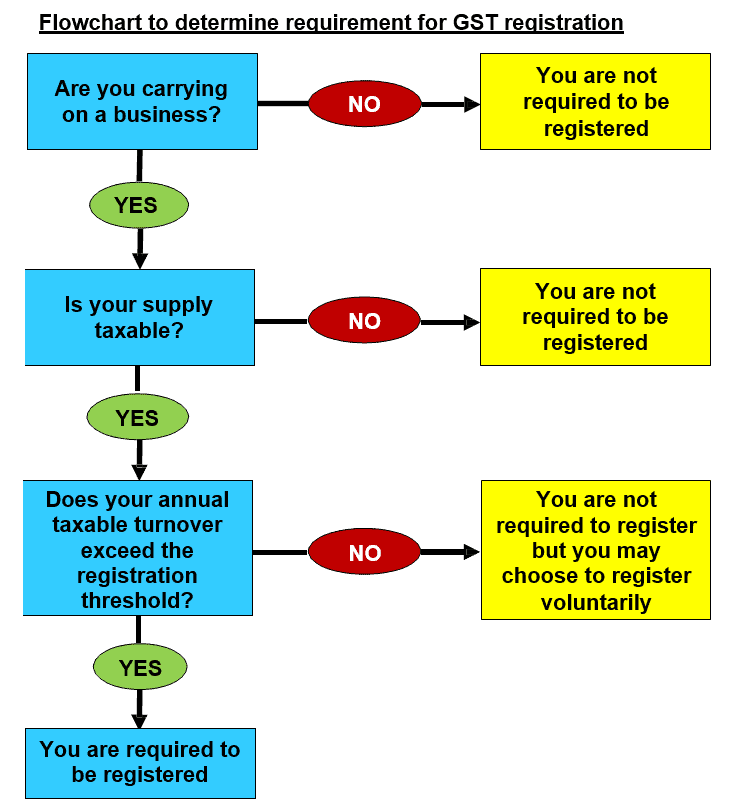

Under Goods Services Tax GST system in Malaysia businesses with annual sales of RM500000 or more oblige to be registered under the GST. Guide on How to Register for GST in Malaysia Step by Step Instructions Details of the company or business the name of the company or business as well as contact. 1 Getting Ready for GST - Registering for GST 2 Registration revised as at 23 April 2014 3 GST Electronic Services Taxpayer Access Point TAP Handbook 4 Click Multimedia Video for Registration.

For GST registration purpose the method to use for computing taxable turnover depends on the business set-up eg. It applies only to the tax paid on goods your purchases at shopping outlets not the GST on food accommodation etc. The first step to being GST-ready is to register for a GST identification number.

In step 3 of the process you should submit the Regulatory Dossier under Form 42. Business registration number as provided by SSM identity card number passport number if not a Malaysian citizen registration number given by ROS or identification. You need to check whether you are required to register or whether you want to register.

Sales tax administered in Malaysia is a single stage tax imposed on the finished goods manufactured in Malaysia and goods imported into Malaysia. A taxable person who is mandatory to be registered under GST Act can complete the application by submitting the prescribed form GST-01. Just follow these instructions from the Malaysian tax authority on how to register for Malaysian GST.

If your business annual sales do. How Do I Register For GST. Go to official GST portal httpswwwgstgovin and under the services tab choose Services Registration New Registration.

Step by step guide on how to register for Malaysian GST. You must apply for GST registration within 28 days from the date the annual taxable turnover exceed RM500000 determined based on either the historical or the future method. Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018.

Online GST Registration Guide by SQL Accounting Malaysia The government is sponsoring 1000 e-voucher to SME for new. Segala maklumat sedia ada adalah untuk rujukan. In step 3 you will verify the OTP and generate the TRN.

Malaysian businesses are required to register for GST when their turnover threshold hits RM500000. On the Registration page enter all the. Ultimately you will receive a GST registration number which establishes you in the.

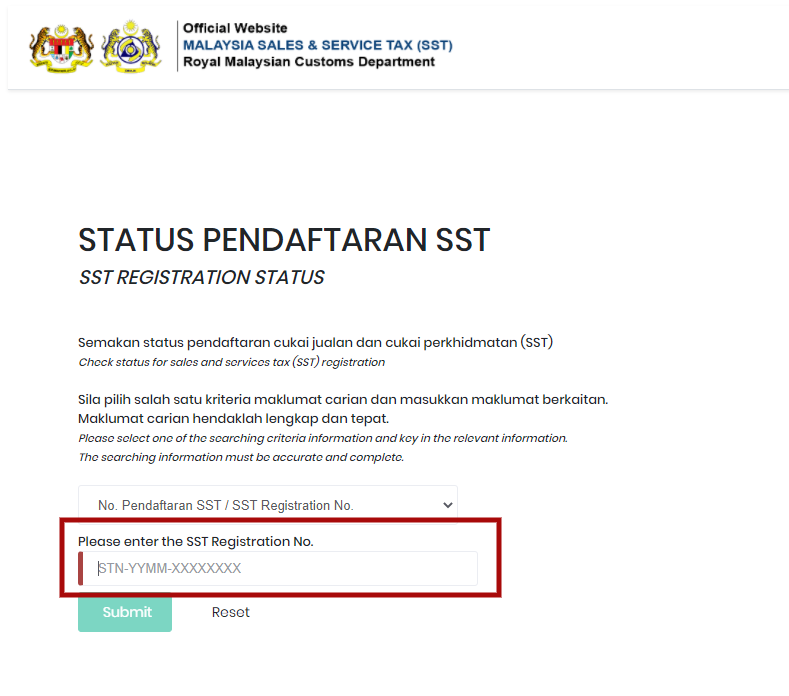

The second step is to appoint a licensed Indian agent. GST registered person who fulfilled the required criteria to be registered but were not registered by 1 September 2018 need to apply for registration through the MySST system within 30 days. The first step is to visit the GST Portal The second step is to produce an OTP by completing the OTP validation.

In determining this threshold income arising from the supply of. It is collected on the value added at each stage of the supply distribution chain 4. How Do I Register For GST Step By Step.

Under Goods Services Tax GST system in Malaysia businesses with annual sales of RM500 000 or more are required to be registered under the GST. A registered person is required to charge output tax on. Complete OTP Validation to generate a TRN.

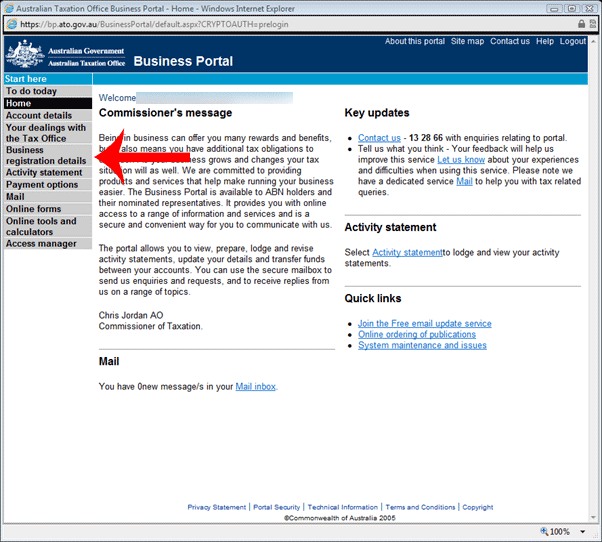

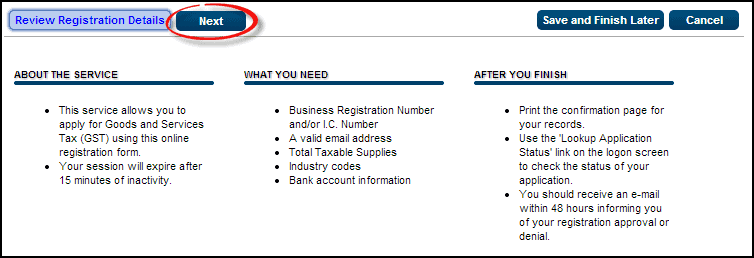

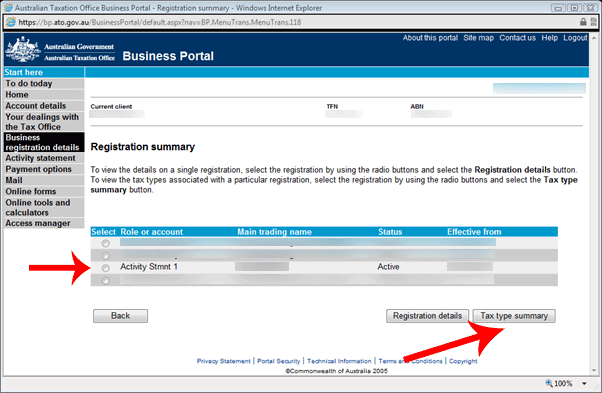

GST is a multi stage tax and is imposed on most business transactions which take place in Malaysia. In Malaysia a person who is registered under the Goods and Services Tax Act 201X is known as a registered person. The Review Registration Details is the instructions on TAP.

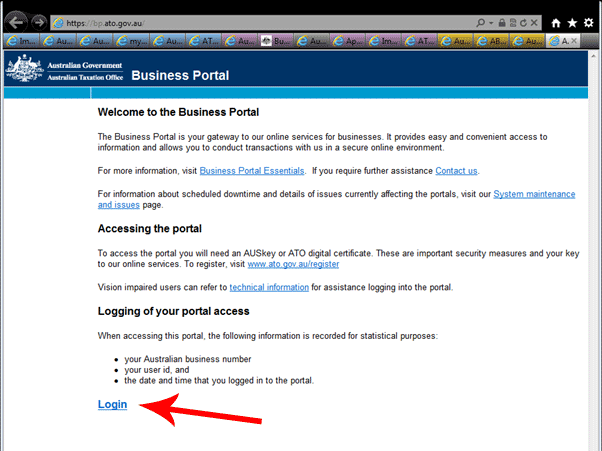

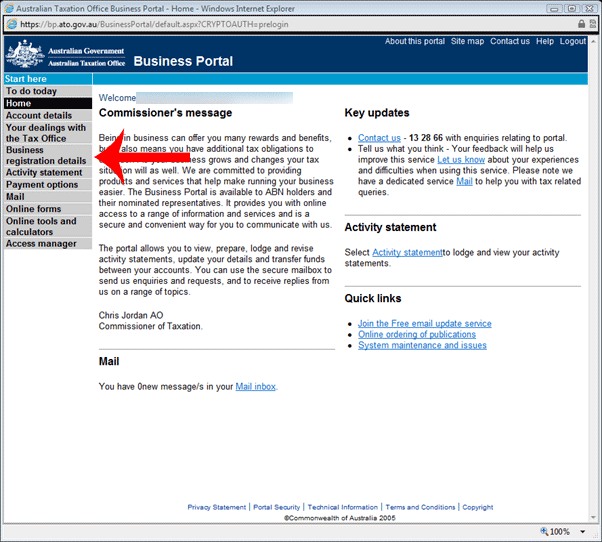

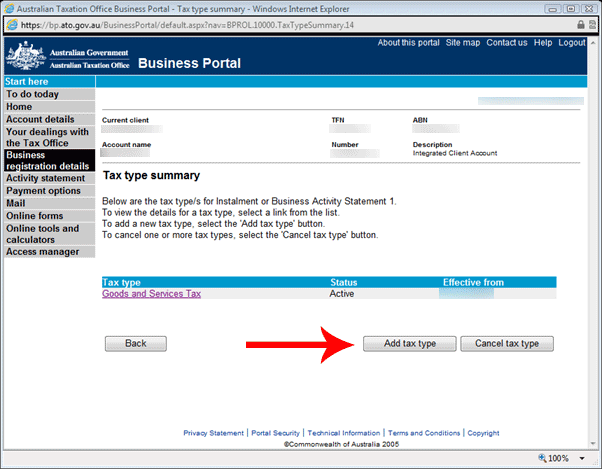

Go to GST TAP website Click Register For GST hyperlink 2. The fourth step is to complete Form 43. The registration forms can be obtained from the.

Malaysia Sst Sales And Service Tax A Complete Guide

Step By Step Guide To Apply For Gst Registration

Gst Change Of Address A Quick And Easy Online Process Ebizfiling

Gstr 11 Pdf Gstr 11 Form Tax Refund Goods And Services Patent Registration

How To Register For Gst If You Already Have An Abn In Australia Hard Answers

How To Register For Gst If You Already Have An Abn In Australia Hard Answers

Point Of Sales System Malaysia Online Pos System Pos Terminal Pos Cash Register Restaurant Cloud Simple Pos System Pos Office Phone

Everything About Gst Registration Of A Private Limited Company Ebizfiling

How To Register For Gst If You Already Have An Abn In Australia Hard Answers

Everything You Need To Know On Gst Registration For Foreigners Ebizfiling

2020 Free Gst Registration How To Apply For New Gst Registration For New Taxpayers Youtube

Nspf Certified Pool Spa Operator Certification Program Spa Pool Pool Teaching

Do I Need To Register For Gst Goods And Services Tax In Malaysia

When Should A Business Apply For Multiple Gst Registrations All One Needs To Know Ipleaders

Malaysia Sst Sales And Service Tax A Complete Guide

Pin By Uncle Lim On G Newspaper Ads Ads Corporate Design

How To Register For Gst If You Already Have An Abn In Australia Hard Answers

Comments

Post a Comment